How to Insure Your Sports Card and Memorabilia Collection

It's something most collectors probably never think about, but they should. When it comes to insuring your collection against unforeseen tragedy or natural disasters, your existing homeowners or renters policy, likely, isn't enough. It probably won't properly compensate you for the current market value of your collection.

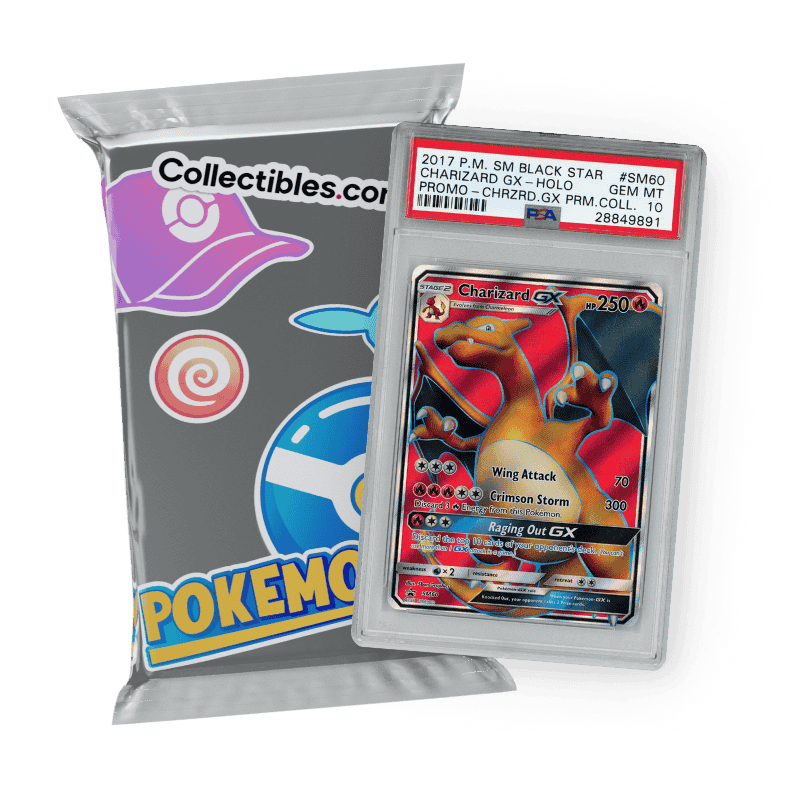

Whether you're a vintage collector or just rip new wax products, there are affordable options to protect the investment you've made in your collection. Two major companies that specialize in collectibles insurance are Collectibles Insurance Services LLC (CIS) and Cornell and Finklemeier (CF). Both have been serving the sports card and memorabilia markets for several years

With regards to the importance of carrying separate collectibles insurance, CF President Tom Finklemeier said, "There's still a flea market mentality among some dealers. They love the things they sell but many of them figure nothing will happen. For those who sell full-time, it becomes doubly sad when they lose not only their inventory, but their income."

What Does Collectibles Insurance Cover?

Headquartered in Maryland, CIS has a long tradition of providing collectibles insurance of all kinds. Underwritten by one of the member companies of Diamond State Group, CIS provides both collectors and dealers with insurance policies that cover a range of events including burglary, theft, fire, flood, breakage and natural disasters. Coverage is also provided for loss or damage that happens during shipping, personal transit and exhibition.

The other major player in the collectibles insurance market is Ohio-based Cornell and Finklemeier. Finklemeier claims to have written the first insurance policy strictly for collectibles more than 25 years ago. The company is the exclusive agency for Travelers Insurance, who underwrite the collectible policies and currently insures between $75 million and $100 million in sports cards and memorabilia. As the annual insurer for the National Sports Collectors Convention, CF is well-versed in the specific needs and nuances of the sports collectibles market.

Like CIS, CF offers dealers and collectors full blanket inventory coverage against theft, earthquakes and floods with few exclusions. CF further caters to the collectibles market by having a collectibles-specific policy form. Valuations with CF are based on fair market value.

How Does It Work?

We spoke with Annemarie Fitzpatrick, the Underwriting Director who heads the collectibles division for CIS and she explained how collectibles insurance works and why it is so important. Understandably, many collectors fear having to keep detailed inventory records but Fitzpatrick states that "A complete inventory is not required except for items valued at $5,000 or more."

Although an inventory is not required at the time of application to buy insurance, she said that, “CIS strongly recommends its customers maintain an inventory to streamline, provide proof and expedite claims in the event of a loss."

She continues, “No pictures are required but they are recommended, especially for high-value items." She went on to explain that, “In most cases, your homeowners insurance is designed to cover personal property and is not nearly enough to protect your collection."

Collectibles Insurance vs. Homeowners Insurance

There are several key differences between collectibles insurance and standard homeowners insurance. In most cases a homeowners or renters policy may:

- Limit contents coverage to a percentage of the total value of your home (usually 50 - 70%).

- Limit the amount they'll pay for theft of valuable items, like your 2001 Bowman Chrome Albert Pujols autographed rookie card.

- Not cover losses due to natural disasters like floods, hurricanes and earthquakes.

- Be based on actual cash value (the documented purchase price) and not the item's current collectible value.

- Require you to schedule all items, including an itemized list and values.

The whole purpose of having your collection insured is to provide adequate compensation in the event of loss or damage. So how does an insurance company calculate a collection's value? Fitzpatrick stated that “Claims are paid based on replacement value at the time of the loss."

This accounts for appreciation in value from the time in which specific items were first purchased or acquired and is the fundamental difference between a homeowners policy and collectibles insurance.

Fitzpatrick warned that unscrupulous collectors and dealers should give a second thought before filing a bogus claim, “Insurance fraud a felony. At the time of loss, the insurance adjuster will thoroughly investigate the claim."

This is one of the reasons, that while not required, it is in the best interests of a collector to keep detailed records.

When asked what percentage of claims are denied by the company, Fitzpatrick said, “Only a small number of collector claims are denied. The most common reason for declination of collector claims is dealer stock, which means the insured was acting as a dealer. CIS offers a separate policy to cover dealers."

CIS reminds collectors that certain types of loss are not covered by them. These include loss as a result of government seizure, war, and, perhaps most notable to collectors, damage or loss caused by rodents.

How Much Does it Cost to Insure Your Collection?

The costs for this type of specialty coverage vary. Factors include whether the policy is for a dealer or collector, the amount of deductible and the overall policy value.

An example of costs for a policy through CIS on a collection with an estimated value of $100,000 would be about $640 with no deductible. The minimum loss to file a claim would have to be greater than $50.

Using current pricing on CF's own application form, insuring a collection valued at $100,000 with a $1,000 deductible would cost about $900 per year.

As you can see, there are differences in price and coverage. It is up to each individual collector to make an educated decision on what's best for them.

Below is a list of guidelines and tips for purchasing insurance, maintaining inventory records and filing a claim.

Collectibles Insurance Checklist

1) Determine if you are a collector, dealer or both. Inquire about your specific policy needs.

2) Compare policies for:

- Types of loss

- Exclusions

- Price per thousand of estimated collection value

- Deductible

- Inventory Requirements

- Policy Fees

- Terms of Payment

3) Be realistic when valuing your collection. The higher the value, the higher the coverage that's needed. More coverage means a bigger premium.

4) Valuate your collection in terms of fair market or the current replacement value.

5) Keep a copy of your inventory and certificates of authenticity in a secure secondary site, away from where your collection is kept. Examples include a safety deposit box or even an email sent to yourself.

6) When taking photos or video of your collection, be sure to capture any and all markings that will help authenticate the piece. Keep digital copies backed up on multiple sources away from your collection. A cloud program such as Dropbox is ideal for storing such digital files.

7) If a loss occurs due to burglary or theft, file a police report immediately.

8) When a loss occurs, gather your records and contact your insurance company immediately with the following information:

- Contact information

- Policy number

- Type and location of loss

- Date of loss

- Claim amount

- Records— inventory sheets, pictures and videos, police reports, receipts, certificates of authenticity, etc.

The content of this page is for informational purposes only. Information contained herein is not intended as, nor does it constitute, legal or professional advice. Cardboard Connection does not endorse the referenced companies nor assumes any liability for the accuracy or completeness of the information received. Reliance on the information provided is at the sole discretion of the user or applicant. Additionally, information contained herein does not constitute any coverage position or coverage recommendation by Cardboard Connection.

| Making purchases through affiliate links can earn the site a commission |